Process Overview

The lifecycle of a gift includes the following stakeholders:

- Development officers

- Administrative assistants

- Business office

- Advancement Services

- Donors

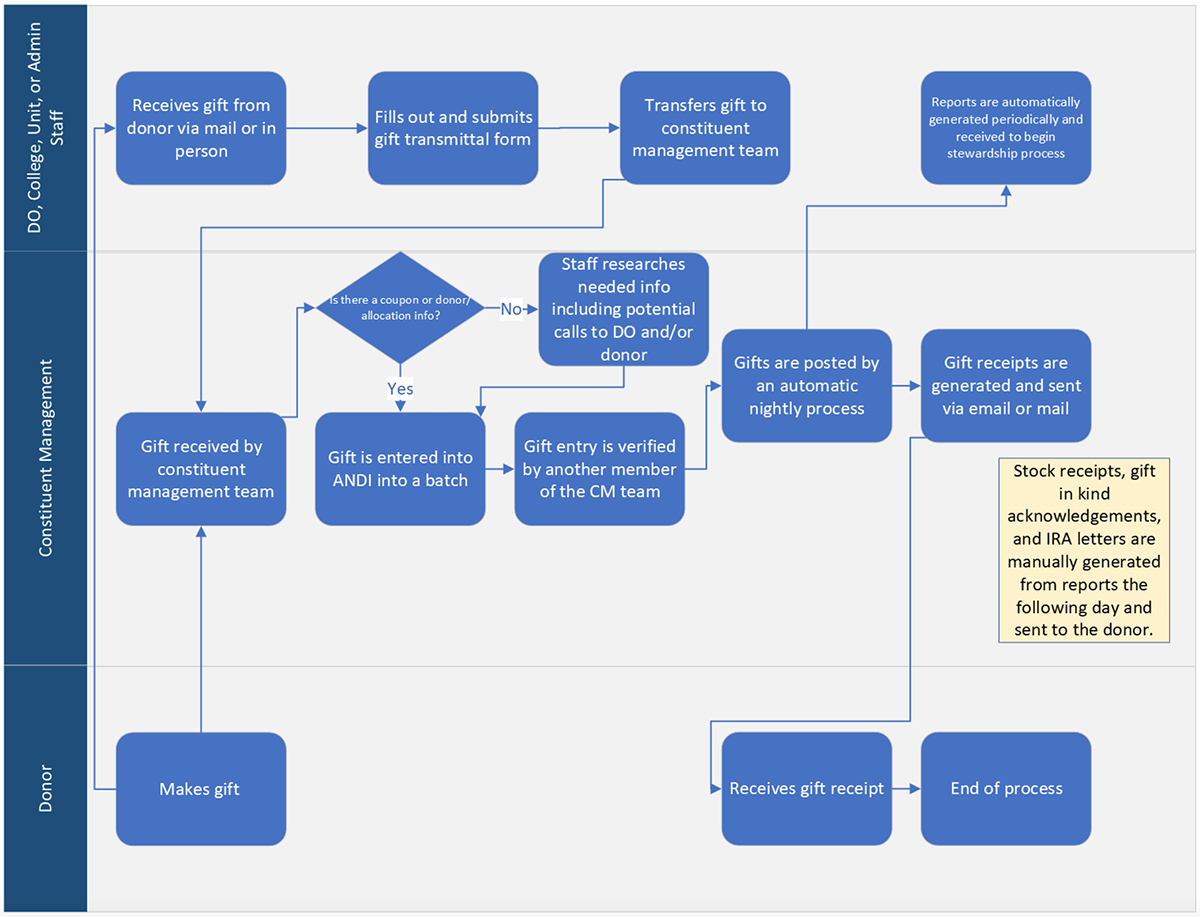

The lifecycle of a gift begins when a donor decides to make a gift. Gifts can be made through various means, such as checks, online credit card transactions, cash, wires, payroll deduction, ACH, stock and many others. Outright gifts of $25,000 or more are typically documented in a gift agreement. Stock gifts are routed through a broker. Gifts that are received in locations other than the Central Services office are documented on a gift transmittal form. Online gifts are collected through a payment processor and a batch is generated for processing. Certain gift types such as stock gifts require additional research to determine the donor’s identity, or the desired designation of the funds.

Once the constituent management team receives the gift, the gift is entered into ANDI through a batch. Transactions are often verified by members of the constituent management team to ensure accuracy. As the gift is entered, it is coded in the appropriate manner to indicate tender type, allocation, and other pertinent details. If the gift is split between spouses, made on-behalf/in honor/in memory of others, special steps must be taken as the gift is entered. All documentation, including checks, are manually scanned for our document repository.

Once the batch is closed, an in-house process runs overnight that posts each gift to the appropriate records in ANDI. Currently, gifts physically received at each campus office are processed at that respective campus, and all online and specialized transactions are processed at the Central Services office.

After a gift is posted in ANDI, a receipt is generated. For donors with valid email addresses (and who have not opted out), e-receipts are emailed. For other donors, receipts are printed and physically mailed. A file is generated to the bank once the deposit is completed the following morning to get the funds deposited in IRIS.

Reports are generated on a regular schedule based on college/unit needs for stewardship.

Opportunities

Improvement opportunities to address current inefficiencies:

1. Gifts with no Coupons

- We run into issues when gifts come in with no coupons

- Research as to be done to determine where the gift goes. The DO often has to be called, and sometimes the donor. This takes time and slows other processes.

2. Receipting

- Generating duplicate receipts is a painful process

- DOs often have to call and request receipts for donors who lost theirs or didn’t receive one. Constituent management has to rerun these, slowing other processes.

- Ideally, DOs could run their own, or perhaps have receipting available in the constituent portal

3. Online Giving

- Not all entities are loaded in iModules.

- John Doe transactions – ID is not in iModules and has to be researched

- Company credit cards – not sure who gift is for

- Other funds not listed – has improved but still an occasional pain point

- Donors making an online gift in response to a direct mail appeal – online appeal code gets assigned

4. Anonymous

- Anonymous gifts can be sometimes difficult to track and process. We would like to see a better and more efficient process for true anonymous gifts, anonymous donors, anonymous organization gifts, non-publicized gifts, etc.

5. Miscellaneous Processing

- Splitting credit between spouses is a manual process and can be improved

- Splitting credit between allocations should be less time consuming

- Payroll deduction: open to overhauling completely. Right now, the process to have a reoccurring payroll deduction and a one-time payroll deduction is a very manual, tedious, and time-consuming process.

- Quid pro quo transactions (i.e. event registrations with a gift component) are very difficult to manage. Especially when there are different price tiers for attendees of the same event.

6. Scanning

- Currently, we have to scan each check twice: once for the bank, and once for ANDI. We would like to reduce that to one scan.

- We would love to see less scanning if possible, and perhaps a remote check capture function for DOs.

7. Gifts from Other Departments

- Athletics and WUOT giving information comes over in an Excel file. We need abetter process for this

8. Miscellaneous Pain Points (that may not be able to be addressed)

- Stock gift donor identities and other info

- DAFs – everything about recording them, receiving them, tracking them, etc.

- Payroll deduction checks from outside entities, such as UT Medical Center

- Researching whether a check should be a gift or a pledge payment

Final Summary

The lifecycle of a gift is a fluid process with unique situations depending on the type of gift, donor, designation, and time of year. Currently, some units use electronic gift transmittal forms, others use paper, and some gifts come in without any forms. This creates research and manual work for the team. There is also additional research by multiple parties when a coupon is not included, and/or a designation is not specified. Online giving can be hampered when donors choose other funds other than what is listed on the giving form. Also, not all donors are in Encompass, which can cause problems when trying to post online batches.

A smoother process is also needed in regards to anonymous gifts and related transactions, as well as the process of splitting transactions and credit. Currently, the payroll deduction process is limited, and recording a one-time payroll deduction when a reoccurring payroll deduction is already in place is a pain point. Quid pro quo transactions are also difficult to deal with. A nightly process runs to post batches in ANDI and the financial interface. Ideally, gifts would be posted in a more timely manner.

Pulling duplicate receipts can be a headache and cause time delays on other processes. Currently, a member of the constituent management team has to pull these receipts. We would love for a DO to be able to do this accurately, or perhaps even a donor within their donor portal profile. The constituent management team would also benefit from improvements in the scanning and document management process, including a reduction of the number of documents scanned.

The constituent management team faces other pain points with stock gifts, donor advised/directed funds, external payroll deduction (UT Medical Center), reconciling gifts with WUOT and Athletics, and also determining if a gift should be recorded as a gift or pledge payment in certain situations. The new CRM needs to address the aforementioned issues and provide alternative solutions to the current pain points in the lifecycle of a gift, which will also go hand-in-hand with many of the current roadblocks in the lifecycle of a pledge.